The Decision Process

How Many Dollars Should I Convert Into Precious Metals?

If you are seeking to convert a (relatively) small sum of money into metals, you may be inclined to purchase metals with smaller denominations. The advantage is flexibility. Smaller coins will afford you the opportunity to sell portions of your holdings, or use those smaller denominations for trade. Popular coins for this purpose might be 1-ounce silver coins, junk silver, or fractional denominations of gold. The disadvantage to smaller denominations is that, as a rule, the smaller the denomination the higher the premium on a percentage basis. (It is more expensive to mint 10 of the 1/10th ounce coins than a single 1-ounce coin.)

For larger investors, the higher premium costs with smaller denominations can become prohibitive, so it is common for larger orders to veer toward 1-ounce and 10-ounce denominations of gold and 100-ounce denominations of silver.

Should I Purchase Gold, Silver, or A Combination?

Generally speaking, gold is more "conservative" than silver because the price is less volatile. The silver market is much smaller than gold and tends to be a more speculative trade influenced by industrial demand (90% of all mined silver is used in industrial applications). The two precious metals often move similarly up or down in price, so it is less common that gold and silver will move in opposite directions. When precious metals prices increase, silver tends to increase much faster than gold on a percentage basis. Conversely, when prices decrease, silver tends to decrease much faster.

The decision to purchase gold or silver is heavily predicated on purpose and risk tolerance. For those approaching retirement age or those seeking insurance for a portfolio or currency hedge, gold tends to be a more popular option. For those with greater speculative appetite, silver offers (in the opinion of some) higher upside potential. Additionally, for “preppers” concerned with systemic risk or an apocalyptic shock, silver tends to be valued as a solution for trading or bartering in smaller quantities.

Platinum shares some of the qualities of gold and silver. While commonly (though not always) trading higher than gold, it is a smaller market than silver with a heavy concentration toward industrial usage.

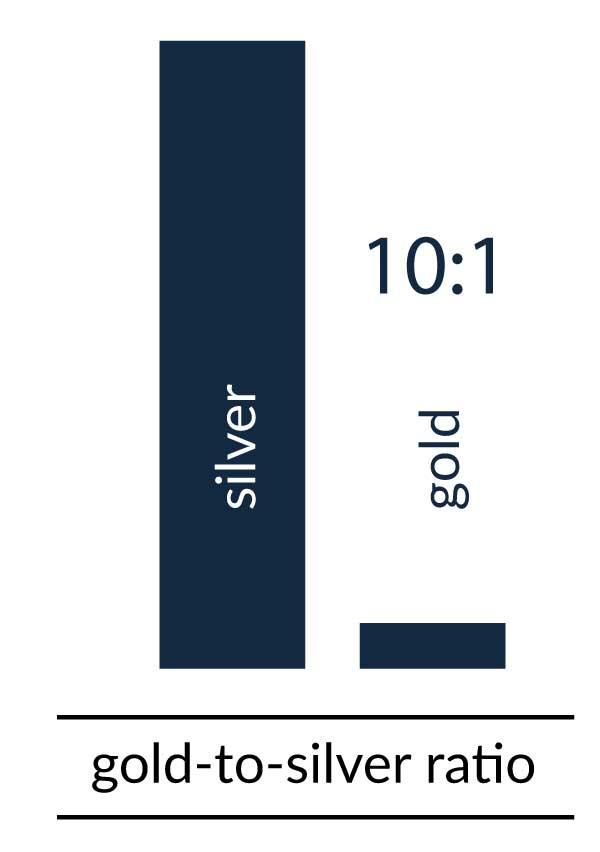

Some precious metals enthusiasts monitor closely the gold-to-silver ratio, which represents the number of ounces of silver needed to equal an ounce of gold. Historically, this relationship has floated anywhere between 10:1 and 20:1, although the ratio has been much larger in recent decades.

A final consideration is size. A $100,000 order of silver could weigh 350 pounds, while a comparable gold order would weigh only 6 or 7 pounds (depending on price). When accounting for the stark per ounce price differential, it is important to note that silver is significantly bulkier than gold.

I Want To Buy Gold. Should I Buy Gold Bars Or Gold Coins? Which Gold Coins Should I Purchase And Why?

There are three main considerations for gold product selection: premium cost, country of origin, and sell-side tax.

Generally, non-legal tender gold bars are cheaper than legal tender coins by a few dollars per ounce. Clients seeking to purchase gold for the least possible price favor gold bars. The larger the bar, the lower the premium per ounce. Gold bars issued from government mints are IRA eligible. The downside is that the IRS requires precious metals dealers to file a 1099-B form when repurchasing 100 troy oz. and 1 kilo gold bars with a minimum amount of 100 troy oz. or 3 kilo bars.

Clients purchasing gold coins may choose from several sovereign mints. The premiums on these coins vary depending on whether the country of issue operates its mint like a business or like a government institution. In our opinion, certain mints operate capitalistically, leveraging efficiencies in the supply chain to offer the lowest premiums to dealers with the intent of increasing market share. On the other hand, the United States Mint tends to be more expensive and less consumer oriented, outsourcing the production of its coin blanks, which leads to higher costs. The United States Mint tends to operate bureaucratically.

I Want To Buy Silver. Should I Buy Silver Bars, Silver Coins, Silver Rounds, Or Junk Silver?

Just as with gold, there are three main considerations for silver product selection: premium cost, country of origin, and sell-side tax. An additional consideration is form factor.

For clients seeking the largest quantity of silver for the least cost (e.g. the best bang for the buck), 100-ounce and 10-ounce bars are a common solution, along with 1-ounce silver rounds, such as the Texas Silver Round. For institutional investors, 1,000-ounce bars are also an option, although not generally preferable for retail investors.

The difference between a “round” and a “coin” is important to understand. A round is a privately minted non-legal tender medallion in the size and shape of a coin. A coin is a product minted by a sovereign mint with legal-tender face value. Both options offer the same silver weight, form factor, and purity (ranging from .999 to .9999 pure depending on product). The round, however, tends to sell at a lower premium because private mints are not subject to the same financial burdens — and taxation — as sovereign mints. Some clients prefer the “official” designation of a sovereign coin, while others prefer to acquire silver in their desired form factor at the lowest cost. It is a matter of personal preference.

“Junk” silver is an industry term for pre-1965 U.S. dimes, quarters, half-dollars, and dollars. These coins are comprised of 90% silver. Since they were at one time in common circulation, they generally have significant wear when compared to “Brilliant Uncirculated” coins or rounds. Certain clients are attracted to junk silver because these coins represent the smallest form factor available for silver products, and the premiums tend to be comparable to 1-ounce silver coins on a per-ounce basis. In other words, there is generally no significant increase in premium despite the smaller size. However, it is worth noting, that these premiums tend to fluctuate more than newly minted products due to finite supplies. The United States Mint no longer produces these coins. Hence, there are acute supply/demand sensitivities in the junk silver market that can lead to higher premiums during times of market volatility.

For silver, there are 1099-B reporting requirements when selling 1,000-ounce bars, with a minimum of 5,000 ounces. All other coins or rounds are exempt from 1099-B reporting.

Read the final chapter: common questions. Or, go back to the first chapter in this series.

Need More Information?

Have questions or want to learn more? We're here to help!

Contact Us for personalized support and answers to your inquiries.