Market News

December 21, 2020

The month of November was a bit of a roller coaster for metals bulls, as price appeared to breakout, only to reverse on vaccine news and become extremely oversold by mid-December. All the more frustrating was the continued sell-off in the US dollar, which many expected to spark the next leg higher in metals prices, but new lows in the dollar coincided with multi-month bottoms in metals. Meanwhile, all attention has since returned to bitcoin, which broke out to all-time highs while metals remained in consolidation mode. So, where are we now?

The thesis that I outlined in my post on October 14th remains the same: Metals up, Equities Up, Dollar down. The expectation then, as now, is for the 2021 reflation/inflation trade. To be clear, this expectation is not based on any personal macro-opinion; it is based on how I see price reacting to this general market consensus. The market can be wrong, and if it is, and inflation expectations are overblown, the price will warn us.

Let’s start with the hot topic du jour: Bitcoin.

BITCOIN

Bitcoin finally eclipsed its 2017 euphoric high last week and screamed to just north of $24,000/coin, which represents the 127.2 Fib Extension measured from the 2017 high to the March 2020 low. Fundamentals aside (are there any?) price looks poised to test $30,000 (the 161.8 Fib extension) on the next thrust. By any technical measure, bitcoin is in a major secular bull market, and the heights it may reach will likely shock many.

SILVER

Silver broke out in a big way in overnight trading with a massive $1.40 move late Sunday, December 20th. After finally breaking through falling resistance of its bull wedge in early December, silver eclipsed the all-important $26 level, which has served as either support or resistance no less than 11 times since 2011, and most recently following the September blow off high. This breakthrough now sets up an initial retest of $30/ounce, with $37 beyond there.

GOLD

Gold has quietly rallied $140 since the big sell-off in late November, and it is now knocking on falling resistance of its multi-month bull flag. As of this writing, price is on the cusp of a breakout at $1910, which sets up a quick retest of $1940 and $1960, above which should push price back north of $2100.

GSR

The Gold:Silver Ratio also continues to trend lower, which is an encouraging sign for bulls, as it implies stronger risk appetite in the space.

US DOLLAR

For the US Dollar, there is not much to add here. The trend is down, and 88 is a very key level, where we should expect to see some near term support. If price doesn't hold there, the US dollar will likely fall into the 70s on the index.

November 23, 2020

In my last post, I commented on the strong breakouts in metals out of bull wedge consolidations. These breakouts were ultimately short-lived and quickly reversed on vaccine news, washing out swing longs and once again pushing price lower to another test of falling resistance. The thesis from that post remains intact – metals continue to remain in strong uptrends with price likely to push to higher highs – but in the near term price continues to digest supply and needs more time.

GOLD

Gold has a confluence of support coming in at 1832, 1828, and 1822. Below there, 1790 lingers as the key breakout level from the 7-year base. With stochastics oversold, the downside on this selloff looks limited. For those with a longer time horizon, the area between 1790-1830 is a strong area of support.

SILVER

In Silver, I am watching 23.08 (retest of 161.8 Fibonacci extension) and 22.57 (the anchored VWAP from March low) as important levels. Like gold, silver is getting a little oversold on stochastics and I think the 22.57-23.08 is very likely to hold.

10-YR NOTES

Gold has been highly correlated to 10-year notes, which have also been consolidating and are now coming into rising support from the October 2018 low. Long consolidations like this within strong uptrends are much more likely to resolve in the direction of the underlying trend, and if 10-year notes rally off support, we can expect gold to be not far behind.

October 15, 2020

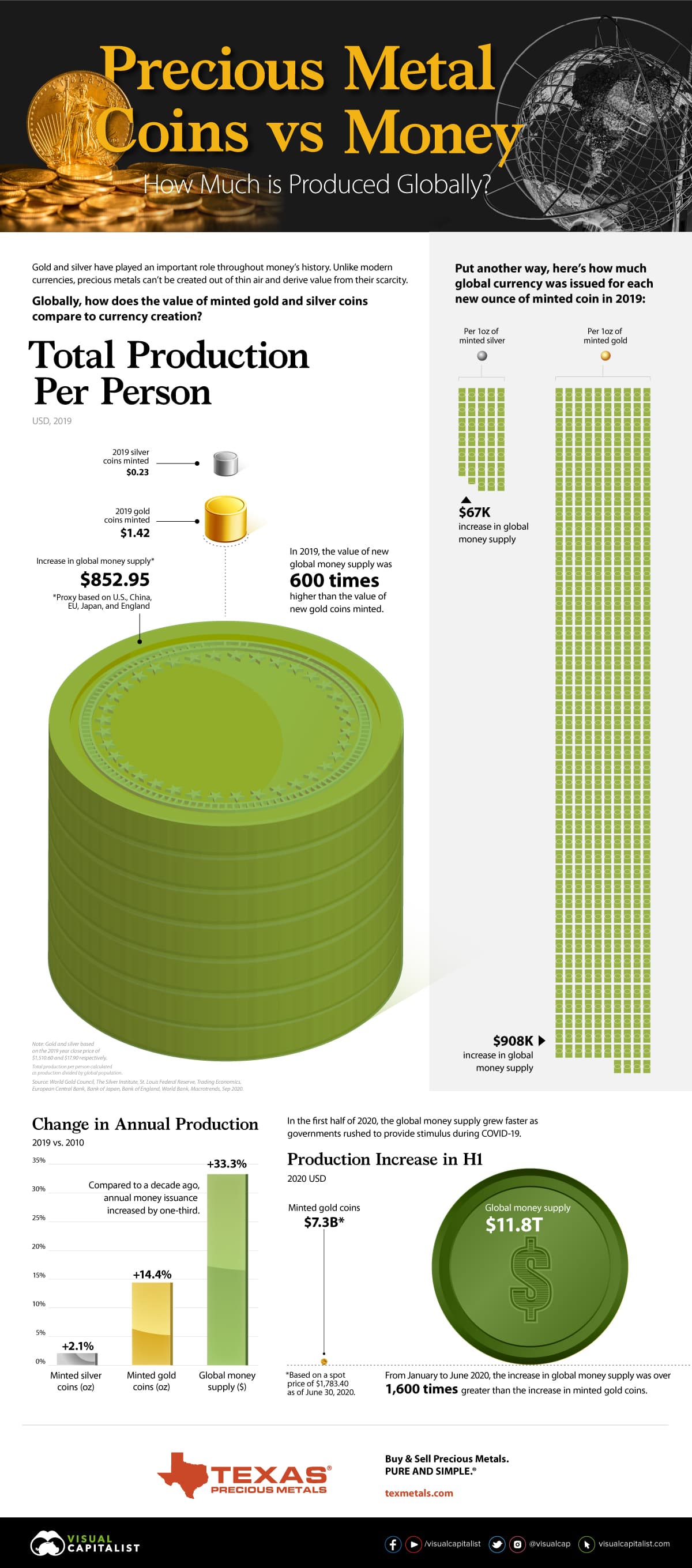

How Much is Produced Globally

Gold and silver have played an important role throughout money's history. Unlike modern currencies, precious metals can't be created out of thin air and derive value from their scarcity.

Globally, how does the value of minted gold and silver coins compare to currency creation?

October 14, 2020

On the topic of future inflationary or deflationary expectations, there are strong fundamental arguments on both sides. In my simple interpretation, the deflationary camp (dollar bulls) make the case that the economy remains fractured, entire industries are being undermined by the pandemic, there is high unemployment, the personal savings rate is up, the stock market is at stretched valuations, the housing market is approaching bubble territory, and the demand for US dollars remains the prevailing undercurrent of international trade. The Fed, despite its best efforts, cannot seem to meet its inflation target. Further economic weakness or perhaps a market crash would incite a flight to liquidity, demand for dollars to meet debt obligations, and broad debt defaults, further tightening the monetary supply. A strong dollar generally weighs heavily on the price of precious metals, particularly in short-term liquidity crises, and creates the potential for a near term headwind on metals prices.

The inflationary camp argues that the Fed – and policymakers – have shown their willingness to do “whatever it takes” to prop up the markets and inject unfathomable amounts of liquidity into the system. There is seemingly no limit to the tools available for this purpose, as we have seen direct stimulus injections into personal bank accounts, Federal programs such as PPP, and other fiscal interventions. In theory, a $1,200 stimulus check could be a $12,000 stimulus check or a $120,000 stimulus check. The government can continue to print, and can even choose to monetize the national debt.

As a technical analyst, these theories are beyond my capability to fully comprehend in whole or predict with any accuracy. I simply look at the charts to determine primary, secondary, and tertiary trends, and what those trends communicate about the environment now. My job is to react to what the market. On that point alone, this is what I see.

THE DOLLAR IS TRENDING DOWN

The primary, multi-decade trend in the dollar remains down. From 2008-2017 the dollar produced a powerful countertrend move that culminated in its third multi-decade lower high. This countertrend move broke down in March, has since pulled back to retest the breakdown, and appears poised for another leg down. The topping pattern formed from 2015-2020 appears to be a diamond reversal pattern. The primary downtrend would be violated only if price moved above falling resistance represented as the upper bound of the falling channel. So, in brief, the long term trend is down, the bullish, decade-long countertrend appears to be over, and it would appear that further weakness is ahead.

GOLD IS TRENDING UP

Conversely, gold is trending up. The countertrend bullish move in the dollar coincided with a countertrend bearish move in gold, which created a 7-year base (continuation pattern) that broke out to all-time highs this year. Gold remains in a 20 year uptrend, and the breakout to new all-time highs suggests that the primary trend is resuming its upward thrust.

THE STOCK MARKET IS TRENDING UP

The S&P500 also remains up. While a crash may be in the offing at some point in the future, the 12-year trend remains up, and even the historic Covid selloff in March was notably just a back test of the two-year price shelf from 2015-2017.

THE S&P500 PRICED IN GOLD IS TRENDING DOWN

Gold outperformance relative to equities remains noteworthy. The primary, 20+ year trend remains down. During the period from 2011-2018 when gold was basing, the S&P500 outperformed gold, but this entire moved appears to be a countertrend 381.% Fibonacci retracement, which broke down in 2019 and now appears to be resuming the downward trajectory of the primary trend. This trend suggest further gold outperformance even if the nominal price of each rises in tandem with a weakening dollar.

The same chart with only the 50 week moving average and 200-week moving average shows only three crosses over the past 20 years. These crosses are infrequent, and the 50 week MA falling through the 200-week MA in March would seem to confirm the expectation of further downside pressure in this ratio.

As always, I would love to know your feedback.

October 08, 2020

Gold and silver have played an important role throughout money's history. Unlike modern currencies, precious metals can't be created out of thin air and derive value from their scarcity.